Introduction

The Invisible Hand is a fundamental concept in classical economics, introduced by Adam Smith in The Wealth of Nations (1776). It describes how individuals pursuing their own self-interest unintentionally benefit society as a whole through the natural workings of a free market.

It emphasizes that, “When individuals act in their own self-interest, they contribute to the overall economic well-being of society—without intending to do so“.

The Invisible Hand suggests that free markets, driven by competition and self-interest, lead to efficient resource allocation and economic prosperity without government intervention.

How the Invisible Hand Works

The mechanism of the Invisible Hand operates through three main forces:

Self-Interest

- Individuals and businesses act to maximize their own profit and utility.

- Consumers seek the best products at the lowest prices.

- Producers seek to make the highest profit by offering goods and services that people want.

Example: A baker doesn’t make bread to feed people out of kindness, but because selling bread is profitable. However, in doing so, the baker feeds the community.

Competition

- Businesses compete with one another to attract customers.

- This leads to innovation, efficiency, and better quality products at lower prices.

- Inefficient businesses either improve or go out of business, ensuring that only productive firms survive.

Example: If one coffee shop charges too much, customers will go to another. This forces businesses to offer fair prices and improve quality.

Supply and Demand

- Prices naturally adjust based on market demand and supply.

- If there is high demand, prices rise, attracting more producers.

- If there is low demand, prices fall, discouraging unnecessary production.

Example: If there is a shortage of wheat, wheat prices rise, encouraging farmers to grow more. This balances the market without government intervention.

The Invisible Hand in Free Markets

Adam Smith argued that market economies function efficiently because of the Invisible Hand, leading to:

Efficient Allocation of Resources – Goods are produced according to consumer demand.

Economic Growth – Businesses innovate and invest in new technologies to stay competitive.

Consumer Choice & Welfare – Consumers get better products at lower prices.

Minimal Government Intervention – The economy self-regulates, reducing the need for heavy regulations.

The Invisible Hand in Different Economic Sectors

Goods and Services Market

- Competition leads to better products and lower prices.

- Businesses naturally respond to customer needs without government intervention.

Labor Market

- Wages are determined by supply and demand.

- High-demand skills (e.g., software engineering) command higher wages.

- Workers move towards higher-paying jobs, balancing the labor market.

International Trade

- Countries specialize in what they produce best and trade with others.

- This leads to global economic efficiency and higher standards of living.

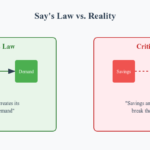

Criticisms and Limitations of the Invisible Hand

Joseph E. Stiglitz

The Nobel Prize-winning economist Joseph E. Stiglitz, says: “the reason that the invisible hand often seems invisible is that it is often not there.”

Noam Chomsky

Noam Chomsky suggests that Smith sometimes used the phrase to refer to a “home bias” for investing domestically in opposition to offshore outsourcing production and neoliberalism.

Thomas Piketty

French economist Thomas Piketty notes that although the Invisible Hand does exist and thus that economic imbalances correct themselves over time, those economic imbalances may lead to an extended unoptimal utility, which could be solved thanks to non-commercial processes.

The Invisible Hand in Modern Economics

Even though the world has moved beyond pure free-market capitalism, the Invisible Hand is still relevant today.

Capitalist Economies

Countries like the United States and the UK rely on free-market principles, allowing businesses to operate with minimal government control.

Mixed Economies

Most economies (e.g Germany, Canada, India) use a mix of free markets and government intervention to balance efficiency with social welfare.

The Digital Economy

Tech companies like Amazon, Google, and Apple thrive because of competition and consumer-driven markets. However, governments intervene when they become too powerful.

Conclusion

Adam Smith’s Invisible Hand remains one of the most influential economic theories. It explains how:

- Markets self-regulate through competition and self-interest.

- Businesses serve society even when they only seek profits.

- Efficiency and innovation thrive without excessive government intervention.

However, the theory is not perfect, and government policies are sometimes needed to address market failures and ensure fairness.