Packing Credit is a pre-shipment financing facility provided by financial institutions to exporters. It enables exporters to fund the purchase, processing, manufacturing, or packing of goods before they are shipped. This type of credit is typically short-term and is offered to help exporters meet their working capital needs.

Normally, banks insist upon their customers to lodge the irrevocable letters of credit opened in favor of the customer by overseas buyers. The letter of credit and firms’ sale contracts not only serve as evidence of a definite arrangement for realization of the export proceeds but also indicate the amount of finance required by the exporter.

Packing credit can be provided in domestic or foreign currency, depending on the nature of the transaction and the agreement between the bank and the exporter.

The tenure of packing credit is usually short-term and is aligned with the shipment schedule, generally ranging from 90 to 180 days.

Key Features of Packing Credit

- Purpose It is specifically meant for financing working capital requirements related to export orders.

- Short term The duration of this credit typically ranges from 90 to 180 days, depending on the export cycle.

- Amount of loan The amount is determined based on the export order or LC value, and disbursements are made in the currency of the exporter’s choice.

- Interest Rate Packing credit loans often have lower interest rates than regular business loans due to their export-focused nature.

- Source of Repayment Generally, repayment is expected from the proceeds of the export shipment.

How Packing Credit Works

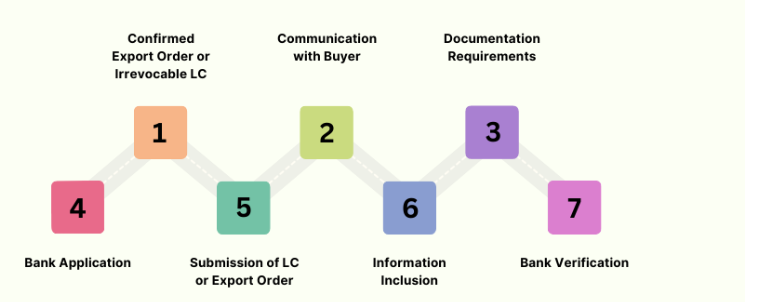

- Obtaining the export order The exporter must have a confirmed export order or a Letter of Credit (LC) from the overseas buyer. This serves as proof of a genuine export transaction.

- Application for Packing Credit The exporter applies for packing credit from a bank by submitting the export order, LC, and other required documents.

- Approval and Disbursement Upon approval, the bank disburses funds directly to the exporter. The amount is usually a percentage of the order value (e.g., 80–90%) and is based on the invoice or LC amount.

- Utilization of Funds The funds can be used for purchasing raw materials, processing or manufacturing goods, packaging, or other pre-shipment expenses.

- Repayment The loan is repaid once the export proceeds are received. The bank may deduct the packing credit loan amount and transfer the balance to the exporter.

Different types of Packing Credit:

Clean Packing Credit

Clean Packing Credit refers to an advance made available to exporters without requiring any collateral or security beyond the export order or letter of credit (LC).It is made only on production of a firm export order without exercising any charge or control over raw materials or finished goods. Each proposal is weighted according to particular requirements of the trade and credit worthiness of the exporter. Also, Export Credit Guarantee Corporation (ECGC) cover should be obtained by the bank.

Packing Credit against hypothecation of goods

Export finance is made available on certain terms and conditions where the exporter has pledgeable interest and the goods are hypothecated to the bank as security with stipulated margin. At the time of utilising the advance, the exporter is required to submit alongwith the firm export order or letter of credit, relative stock statements and thereafter continue submitting whenever there is any movement in stocks.In this arrangement, the exporter retains ownership and possession of the goods, but the lender has a legal right over them as collateral until the credit is repaid.

Packing credit against pledge of goods

Export finance is made available on certain terms and conditions where the exportable finished goods are pledged to the banks with approved clearing agents who will ship the same from time to time as required by the exporter. In this arrangement, the lender (usually a bank) takes possession of the goods as collateral, and the exporter regains access to the goods only after the loan is repaid.

Notes:

E.C.G.C. guarantee

Any loan given to an exporter for the manufacture, processing, purchasing, or packing of goods meant for export against a firm order qualifies for the packing credit guarantee issued by Export Credit Guarantee Corporation.

Forward exchange contract

Another requirement of the packing credit facility is that if the export bill is to be drawn in a foreign currency, the exporter should enter into a forward exchange contract with the bank, thereby avoiding risk involved in a possible change in the rate of exchange.

https://www.credlix.com/blogs/how-does-packing-credit-work-in-export