Say’s Law, formulated by the French economist Jean-Baptiste Say in the early 19th century, is a fundamental principle of classical economics. The law is often summarized as:

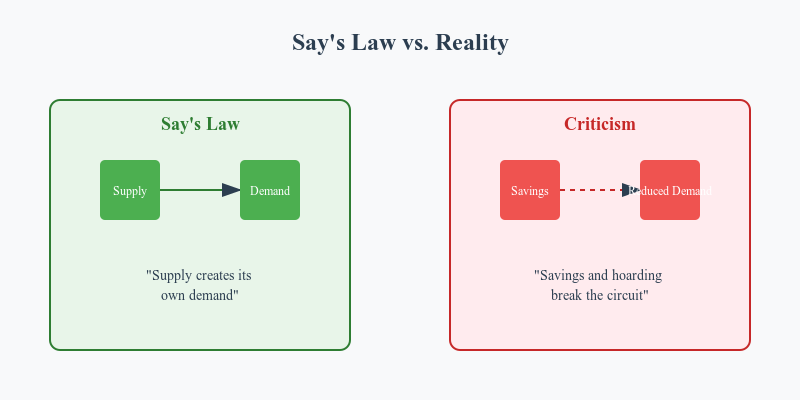

“Supply creates its own demand.”

This means that the production of goods and services automatically generates enough income to purchase those goods and services, ensuring that markets will always clear (i.e. no prolonged overproduction or unemployment).

Say’s Law was widely accepted by classical economists such as Adam Smith, David Ricardo, and John Stuart Mill, but it was later challenged by John Maynard Keynes during the Great Depression.

Understanding Say’s Law

- Production creates income

When goods and services are produced, wages, rents, interest, and profits are paid to the factors of production (labor, land, and capital).

- Income leads to spending

These earnings are then spent on other goods and services, ensuring continuous economic activity.

- No general overproduction

Since production generates the income necessary to buy goods, supply always equals demand in the long run.

Implications of Say’s Law

Say drew four conclusions from his law.

- The greater the number of producers and a variety of products in an economy, the more prosperous it will be. Conversely, those members of a society who consume and do not produce will be a drag on the economy.

- The success of one producer or industry will benefit other producers and industries whose output they subsequently purchase, and businesses will be more successful when they locate near or trade with other successful businesses. This also means that government policy that encourages production, investment, and prosperity in neighboring countries will redound to the benefit of the domestic economy as well.

- The importation of goods, even at a trade deficit, is beneficial to the domestic economy.

- The encouragement of consumption is not beneficial, but harmful, to the economy. Good economic policy should consist of encouraging industry and productive activity in general, while leaving the specific direction of which goods to produce and how up to investors, entrepreneurs, and workers in accord with market incentives.

Say’s Law thus contradicted the popular mercantilist view that money is the source of wealth, that the economic interests of industries and countries are in conflict with one another, and that imports are harmful to an economy.

Later Economists and Say’s Law

Say’s Law still lives on in modern neoclassical economic models, and it has also influenced supply-side economists. Supply-side economists especially believe that tax breaks for businesses and other policies intended to spur production, without distorting economic processes, are the best prescription for economic policy, in agreement with the implications of Say’s Law.

Say’s Law was a cornerstone of classical economic thought, which emphasized:

- Self-regulating markets

- Full employment in the long run

- Flexibility of wages and prices

Classical economists believed that if a recession occurred, wages and prices would fall, encouraging firms to hire more workers and restore economic balance.

Criticism of Say’s Law by Keynes

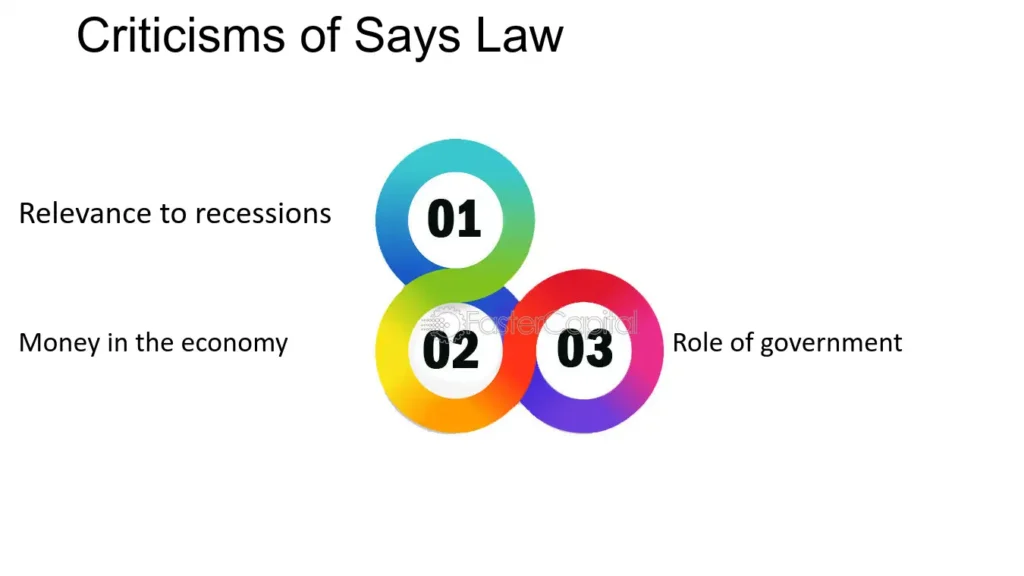

During the Great Depression (1929–1939), economies experienced high unemployment and excess capacity, contradicting Say’s Law. John Maynard Keynes challenged Say’s Law in The General Theory of Employment, Interest, and Money (1936), arguing that:

Demand Drives the Economy, Not Just Supply

- Keynes argued that if people don’t spend enough, businesses won’t sell their goods, leading to layoffs and lower incomes.

- Production alone doesn’t guarantee demand—consumers must be willing and able to buy.

Saving Can Lead to Economic Decline

- If people save too much and don’t spend, businesses lose revenue, reducing investment and employment.

- This creates a downward spiral where lower demand leads to lower production, reinforcing economic decline.

Government Intervention is Necessary

- Keynes argued that during recessions, governments should increase spending (fiscal stimulus) to boost demand and restore growth.

Modern Relevance of Say’s Law

Free-Market Capitalism

- Supporters of free markets (like Milton Friedman and Austrian economists) still argue that Say’s Law holds in the long run.

- Supply-side economists believe that increasing production and reducing regulation will naturally create demand.

Recessions and Stimulus Policies

- Modern economists accept that in the short run, demand shortages can occur, requiring government intervention.

- Central banks (like the Federal Reserve) manage demand through monetary policy (interest rates, money supply).

The Bottom Line

Say’s Law posits that the production of goods creates demand by generating the income one would need to purchase other goods. This theory, also known as the law of markets, was introduced by the French economist Jean-Baptiste Say. It continues to have resonance including among supply-side economists, as well as detractors among Keynesians.