The Liquidity Preference Theory, developed by economist John Maynard Keynes, explains the demand for money and the relationship between interest rates and the public’s preference for holding liquid assets (cash) versus other financial assets like bonds.

This theory is a key component of Keynesian economics, especially in understanding monetary policy and how interest rates are determined in the economy.

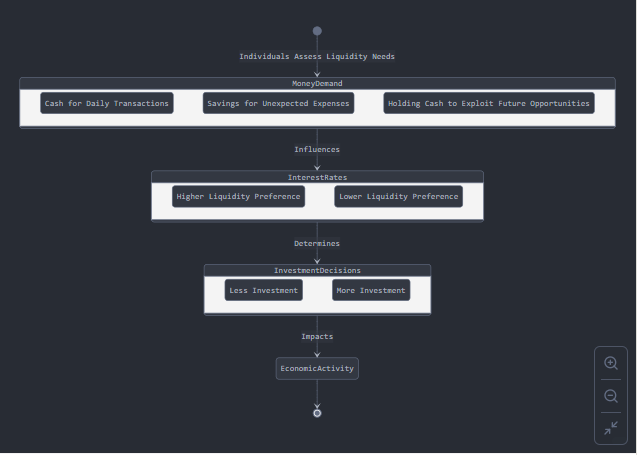

This diagram illustrates Keynes’ Liquidity Preference Theory by showing how individuals’ desire for cash (liquidity) interacts with interest rates and investment decisions. The flow demonstrates that:

- People hold money for transaction, precautionary, and speculative motives

- These motives influence interest rates

- Interest rates affect investment decisions

- Investment decisions impact overall economic activity

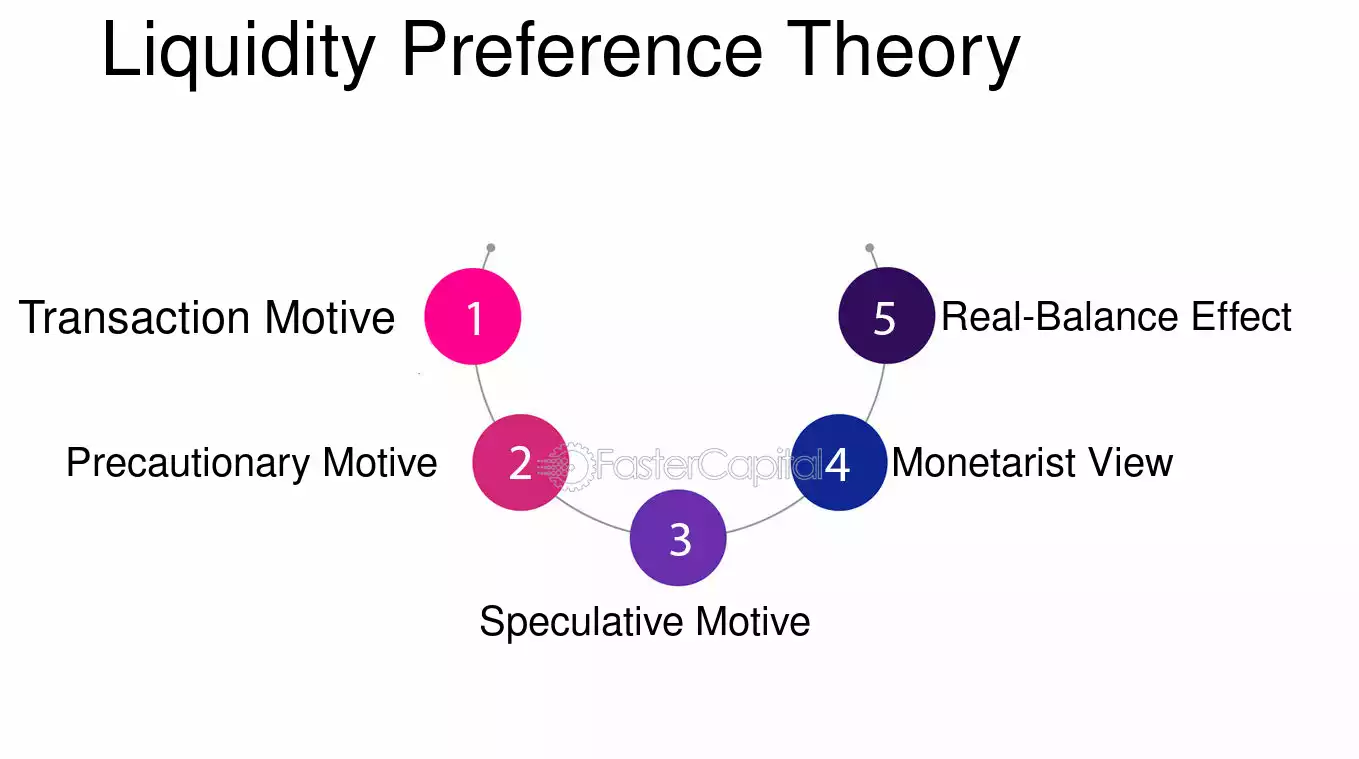

This theory emphasizes following key concepts.

Three Motives for Holding Money

According to Keynes, individuals and businesses hold money for three primary reasons:

- Transaction Motive: People need money for everyday transactions (buying goods, paying bills). The demand for money under this motive is determined by income levels and the frequency of transactions.

- Precautionary Motive: People hold money to cover unexpected expenses or emergencies. The demand for money here also depends on income levels and economic uncertainty.

- Speculative Motive: People hold money to take advantage of future investment opportunities, especially when they expect that bond prices will fall or interest rates will rise. If people expect interest rates to rise, they may prefer to hold cash rather than bonds to avoid capital losses

Interest Rates and Liquidity Preference

The key relationship in liquidity preference theory is between interest rates and the demand for money. Keynes argued that:

- When interest rates are low, people expect them to rise, which would lead to a fall in bond prices. As a result, people will prefer to hold money (cash) rather than bonds,which increases the demand for money.

- When interest rates are high, people expect them to fall, leading to a rise in bond prices. In this case, people are more willing to hold bonds rather than money, reducing the demand for cash.

Interest Rates and Money Supply

- The supply of the money in the economy is determined by central bank.

- Interest rates are determined by the interaction of money demand and money supply.

- If the central bank increases the money supply, it reduces interest rates because there’s more money available than people demand. Conversely, if the central bank decreases the money supply, interest rates rise as the demand for money exceeds the available supply.

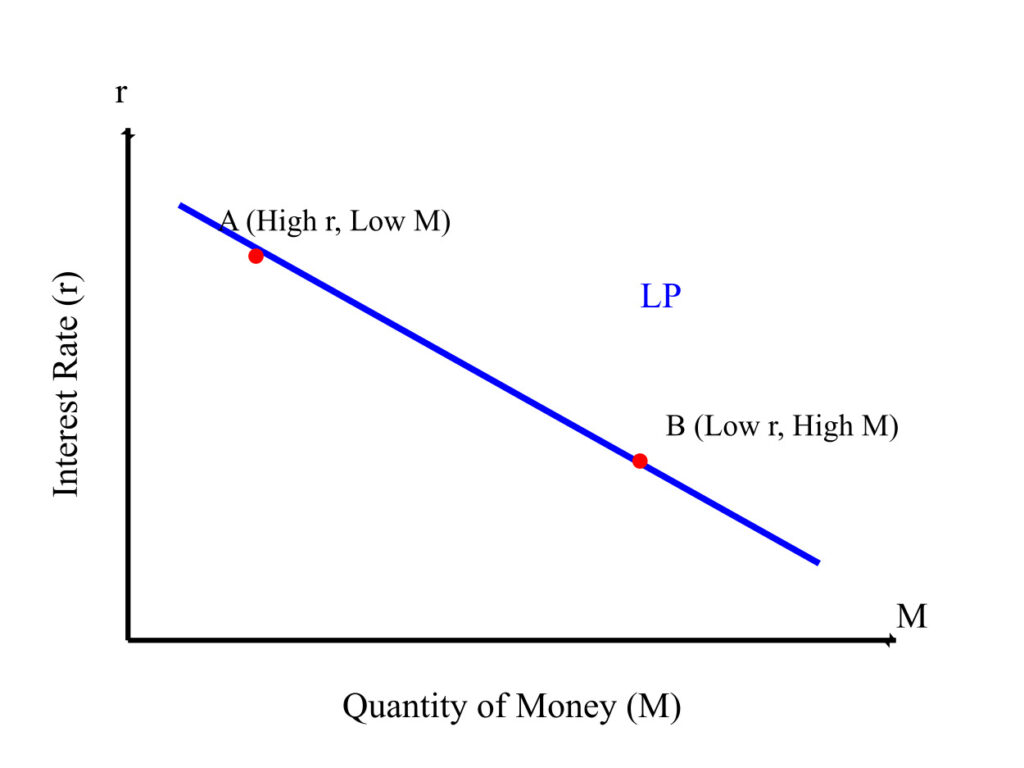

The Liquidity Preference Curve (Money Demand Curve)

The liquidity-preference relation can be represented graphically as a schedule of the money demanded at each different interest rate. The supply of money together with the liquidity-preference curve in theory interact to determine the interest rate at which the quantity of money demanded equals the quantity of money supplied.

The liquidity preference theory is typically represented by a downward-sloping demand curve for money. A liquidity preference curve is a graph that shows how the amount of money people want to hold changes as interest rates changes.

This relationship demonstrates that as interest rates fall, people want to hold more money, and vice versa. This is because:

- Higher interest rates make the opportunity cost of holding money greater.

- Lower interest rates reduce the opportunity cost of holding money.

Liquidity Trap

A critical concept within the liquidity preference theory is the liquidity trap.

A liquidity trap occurs when interest rates are so low that people prefer to hold money rather than bonds, because they expect no further decrease in interest rates and anticipate capital losses on bonds if rates rise.

In a liquidity trap, increases in the money supply do not lead to lower interest rates or increased investment, because people are hoarding cash. This scenario can make monetary policy ineffective in stimulating the economy.

Importance of Liquidity Preference Theory in Management and Policy

- Monetary Policy

Central banks use this theory to influence interest rates by controlling the money supply. By understanding the liquidity preference of the public, policymakers can set interest rates that stimulate or cool down economic activity.

- Investment decisions

Firms can use liquidity preference theory to predict how changes in interest rates will influence the availability of credit, the cost of borrowing, and overall economic conditions, which affect investment strategies.

- Macroeconomic Stability

The theory explains how fluctuations in interest rates and money supply can impact aggregate demand, influencing economic growth, inflation, and employment levels.

Conclusion

Keynes’ Liquidity Preference Theory remains a fundamental concept in economics, particularly in understanding how interest rates are determined and how they interact with people’s preferences for liquidity. It plays a crucial role in guiding monetary policy and shaping economic decisions.