Debt securitization is a financial process where certain types of debt, such as loans, mortgages, or receivables, are pooled together and then sold as securities to investors. This technique enables lenders to convert illiquid assets into liquid, tradable assets. It’s a common financing mechanism that allows originators to transfer debt-related assets off their balance sheets, which can free up capital and reduce risk exposure.

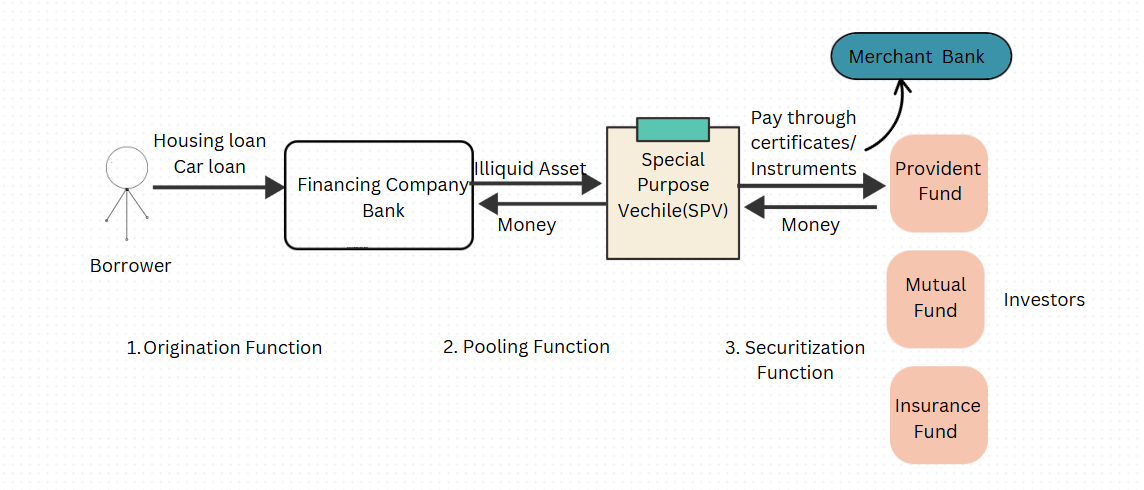

The key steps of debt securitization process are as follows:

- The Origination Function

A borrower seeks a loan from a finance company, bank. The credit worthiness of the borrower is evaluated and a contract is entered into with repayment schedule structured over the life of the loan.

- The Pooling Function

Similar loans on receivables are clubbed together to create an underlying pool of assets. The pool is transferred in favour of a Special purpose Vehicle (SPV), which acts as a trustee for investors.

- The Securitization Function

SPV will structure and issue securities on the basis of asset pool. The securities carry a coupon and expected maturity date. These are generally sold to investors through merchant bankers. Generally investors are pension funds, mutual funds, insurance funds.

Benefits of Debt Securitization

The main reason for securitization is to reduce a company’s funding costs. Through securitization, a company that has a low credit rating but maintains assets that are very high in quality can borrow at significantly lower rates, using the high-quality assets as collateral, as opposed to issuing unsecured debt. Some of the benefits are as follows:

- Improvement of Liquidity

Securitization allows originators to convert illiquid assets into cash, improving their liquidity position and enabling further lending or investment.

- Transfer of Risk

The originator or lender or bank can transfer the credit risk associated with the pooled assets to the investors, reducing the risk exposure on their balance sheet.

- Access to Capital

It can be a cost-effective way to raise funds compared to traditional borrowing methods. Further, it also provides broader acess to capital market.

- Investment Opportunities

For investors, it offer a way to diversify their portfolios and invest in asset classes they might not have direct access to.

- Financial Leverage

The originator can also gain some financial leverage from the financial entities. This can certainly help when the originator is in need of some cash.

- Diversified Portfolio

The financial entities get to diversify its portfolio by bringing in securitized securities. These bonds are a lot different than any other form of security.

There are some drawbacks of debt securitization process. Here are some of the disadvantages of financing through debt securitization.

- Since, mostly the investors in this process are Mutual Funds, Insurance Funds, Pension funds, there’s very little to no transparency between an investor and the bank. That means an investor has very little knowledge of the kind of assets that are involved in the said bond.

- The default risk lies with the investors. That is the investors are the ones at the highest risk and the originator gains the most.

- There are a lot of processes and functions involved in securitization, including legal proceedings, administrative among others. This increases the cost of securitized bonds.

- As the securitization process involves multiple parties, handling everything can be a difficult process.

Types of Debt Securitization

1. Collateralized Debt Obligations (CDOs)

It involves pooling various types of debt obligations, including loans and other securitized products.

2. Mortgage Backed Securities (MBS)

These securities are backed by a pool of mortgages. These are subdivided into Residential MBS (RMBS) and Commercial MBS (CMBS).

3. Asset Backed Securities (ABS)

These securities are backed by non-mortgage assets such as credit card receivables, auto loans, or personal loans.

Key Takeaways

https://en.wikipedia.org/wiki/Securitization

- Debt securitization is the process of packaging debts from a number of sources into a single security to be sold to investors.

- Many such securities are batches of home mortgage loans that are sold by the banks that granted them.

- The buyer is typically a trust that converts the loans into a marketable security.